Tax Season: Ready, set, file!

[Disclaimer: The information provided in this blog post about taxes is for general informational purposes only and should not be construed as professional advice. I am not an accountant by trade and therefore, I strongly recommend consulting a licensed accountant or tax professional for specific advice tailored to your individual situation. While I have made every effort to ensure the accuracy of the information presented, I cannot guarantee that it is free from errors or omissions. The use of the information provided in this blog is solely at your own risk.]

FADE IN:

EXT. MY HOME OFFICE – FRIDAY, 2 PM

It’s a beautiful, sunny day outside, but inside my home office, I am thriving in motion! Tax season has snuck up on me, and with the May 1 deadline looming, while I am still at work and my list of to-do is growing.

I’m surrounded by piles of papers, and I’ve just decided to take the afternoon off from work to start the hunt for my tax-related documents. The clock is ticking away, and I know I need to act fast if I’m going to get this done in time.

CUT TO:

INT. MY HOME OFFICE – LATER

After making multiple calls and sending a few emails, I turn to TurboTax to help me navigate the complex world of tax filing. Memories of using it in my student days flood back, and I’m grateful for the software’s ease of use and accuracy.

I even get the opportunity to review my return with an accountant on a call, who goes by the name of Renee from Turbotax. She’s amazing, and I feel a sense of relief knowing that everything is in order.

CUT TO:

INT. MY HOME OFFICE – LATER STILL

Despite the stress of running around and trying to remember everything, I manage to stay in control and focused on the task at hand. The clock ticks down, but I know I’m making progress. I’m determined to get this done and start my weekend off right.

CUT TO:

EXT. MY LIVING ROOM – DARK AND 6 PM

As the sun sets and the clock strikes 6 pm, I finally finish my last-minute tax filing. It’s been an interesting few hours, but I feel a sense of pride and accomplishment.

FADE OUT:

If you ever find yourself in a similar situation, take heart. With the right tools and mindset, you too can handle last-minute tax filing like a pro. Just remember to breathe, stay organized, and maybe do a little victory dance when you’re done.

***

Filing taxes can be a stressful process, especially if you’re doing it last minute. Whether you’ve been putting it off or simply had a busy year, there are still steps you can take to make the process smoother and more manageable. By planning ahead and staying organized, you can ensure that you file your taxes accurately and on time, avoiding costly penalties and interest charges. In this post, I will share my experience of filing my taxes this year. It’s been a few years since I had to file my taxes via an accountant due to maybe a reason that can have its own post.

As a busy Canadian, finding the time to do your taxes can be a challenge. It has always been the case for me. That’s where TurboTax comes in (at least this year for me) – a tax preparation software that helps you file your taxes from the comfort of your own home. In the following few paragraphs, I take a closer look at what TurboTax is, what packages they offer, and the pros and cons of using their services (in my view). I also share my perspective about the benefits of using TurboTax versus hiring an accountant, additional useful information about the tax season and relevant deadlines, and how to be prepared to file your taxes next year.

What is TurboTax?

TurboTax is a tax preparation software that helps individuals and small business owners file their taxes online. Developed by Intuit, TurboTax is designed to make the tax filing process as simple and easy as possible. With TurboTax, you don’t need to be a tax expert to file your taxes. The software guides you through each step of the process and even checks your work for errors and deductions you might have missed. It conveniently connects to your CRA account and transfers your information so you don’t need to manually enter the details. Lastly, before filing, it makes some recommendations based on your entries that you might find helpful.

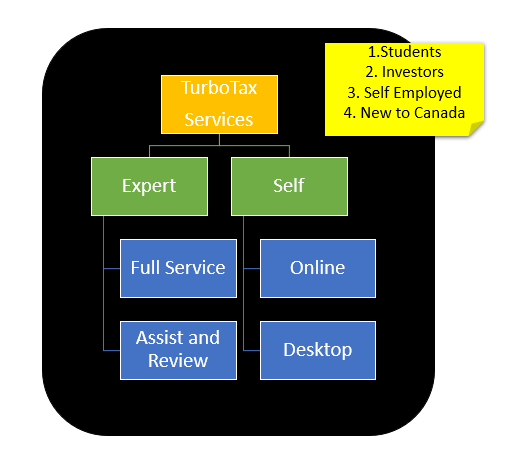

Services

TurboTax offers both on demand and expert services to different audience. The options and cost of each service varies. You start filing withought any commitment and along the day, you can choose which additional options you may want to add to your service package.

TurboTax versus Hiring an Accountant

One of the benefits of using TurboTax is the cost savings. Hiring an accountant can be expensive, especially if you have a more complex tax situation. With TurboTax, you can file your taxes for a fraction of the cost. Additionally, TurboTax is easy to use, and you can file your taxes on your own time, without having to schedule an appointment with an accountant.

However, if you have a particularly complex tax situation or you’re unsure about how to handle a certain deduction or credit, it may be worth consulting with an accountant. They can provide more personalized advice and help ensure that you’re claiming all the deductions you’re entitled to.

TurboTax: Pros and Cons

There are several pros and cons to consider when using TurboTax. Here are some of the main ones:

Pros:

- Cost-effective: TurboTax is significantly cheaper than hiring an accountant, making it a great option for those on a budget.

- Convenience: TurboTax allows you to file your taxes from anywhere, at any time, without having to leave your home or office.

- User-friendly: TurboTax is designed to be user-friendly, making it easy to file your taxes even if you’re not a tax expert.

- Accuracy: TurboTax checks your work for errors and missed deductions, ensuring that your tax return is as accurate as possible.

Cons:

- Limited support: if you speak with an accountant and need a follow up you will be directed to customer support. There is a way to easily reach an accountant but the process is not clear. Customer support calls back in five minutes, while an accountant calls back in about 60 min. I was a bit confused about the level of knowledge until one of the support agents explained the difference to me.

- Technical issues: As with any software, there is a risk of technical issues or glitches that could impact your ability to file your taxes. I didn’t run into any issues and I am not aware of any but it’s always safe to assume any application can face glitches.

- Security concerns: While TurboTax takes security seriously and has measures in place to protect your data, there is always a risk of data breaches or other security issues.

In conclusion, TurboTax is a great option for busy folks who don’t have the time or budget to hire an accountant. With its range of packages and user-friendly interface, TurboTax makes it easy to file your taxes and claim all the deductions and credits you’re entitled to. If you’re looking for a fast, easy, and affordable way to file your taxes, consider giving TurboTax a try.

Deadlines

Tax season in Canada runs from February to April, with the filing deadline on April 30th. Self-employed individuals or those with a balance owed may have different deadlines. To start filing with TurboTax, have all relevant documents like T4 slips, medical expenses, charitable donations and others, as well as your social insurance number and investment/rental property info. Log in and TurboTax will guide you through each step, asking questions about income and expenses, and any deductions/credits you may be eligible for. It’s much easier than expected.

I am going to take more charge of my tax filing and stay as independent of accountants as I can. This year I am planning to invest more in educating myself about taxes. The following are some additional resources that you can Google to educate yourself about taxes.

Additional Resources

Blogs:

Influencers:

YouTube Channels:

Podcasts:

- Life in the Tax Lane

- The Tax Chick Podcast

- UFile Your Taxes, Your Way

- Canadian Taxpayers Podcast

- Podbytes by KPMG

- The Dentons Canada Tax Insights

- TaxBreaks

- Tax Less Taxing

By using these additional resources, you can expand your knowledge about taxes and personal finance.

Government Resources:

Canada Revenue Agency (CRA) offers access to reliable and up-to-date information on taxes. Visit them regularly to ensure you are following the correct procedures and regulations.

Plan

To prepare for next year’s tax filing, keep track of income, expenses, credits, and deductions claimed on your previous return. Use accounting software or apps to make it easier. Research available tax credits and deductions for the year to maximize savings. Contribute to an RRSP throughout the year to further reduce your tax bill. Track charitable donations and get receipts to claim them on your return. To ensure you’re on track, consult a tax professional early in the year. By following this plan, you can stay organized, save money, and be prepared for the upcoming tax season.

Templates

Accountants usually command how organized I am in sharing my financial information with them. Here are a few template ideas that you can use to track your income and expenses for tax filing purposes:

- Income Tracker: to track sources of income, including wages, self-employment income, and investment income.

- Expense Tracker: to track all expenses throughout the year, including rent, utilities, transportation costs, and business expenses.

- Rental Propety Tracker: to track income, expenses and property along with maintenace fees.

- Mileage Tracker: If you use your personal vehicle for work-related purposes, you can use a mileage tracker to keep track of your business-related mileage to calculate the mileage deduction for tax purposes.

- Donation Tracker: to keep track of your donations and ensure you have the necessary documentation for tax purposes.

There are many free templates available online that you can download and customize to suit your needs. If you need help, contact me and I’d be happy to help you create a template for your own use.

Checklist

Here is an initial checklist of everything a you may need when filing taxes:

- Social Insurance Number (SIN)

- T4 slips from all employers

- T5 slips for investment income

- Receipts for any tax-deductible expenses, such as medical expenses or charitable donations

- Information about any other income, such as rental income or self-employment income

- Records of any taxes already paid, such as income tax installments or taxes withheld by employers

- Information about any foreign income or assets

- Information about any capital gains or losses from investments

- Information about any RRSP contributions or withdrawals

- Information about any other deductions or credits you may be eligible for, such as tuition fees or childcare expenses

It’s important to keep track of all these documents and information throughout the year to make tax filing easier and more accurate. By staying organized and keeping up-to-date records, you can avoid last-minute scrambling and ensure that you claim all the deductions and credits you’re entitled to.

If you made it here, this the end of some of my thoughts, experiences and resources about taxes. I hope it was helpful to you. I am glad I took the lead to file my taxes on my own rather than working with an accountant this year. It was a rewarding experience in a way that triggered additional resrearch and learning new things, which I always enjoy.

0 Comments